Many New Zealanders probably do not realise they are paying what is effectively a capital gains tax on some of their investments, even if they’re not banking the money, one financial adviser says.

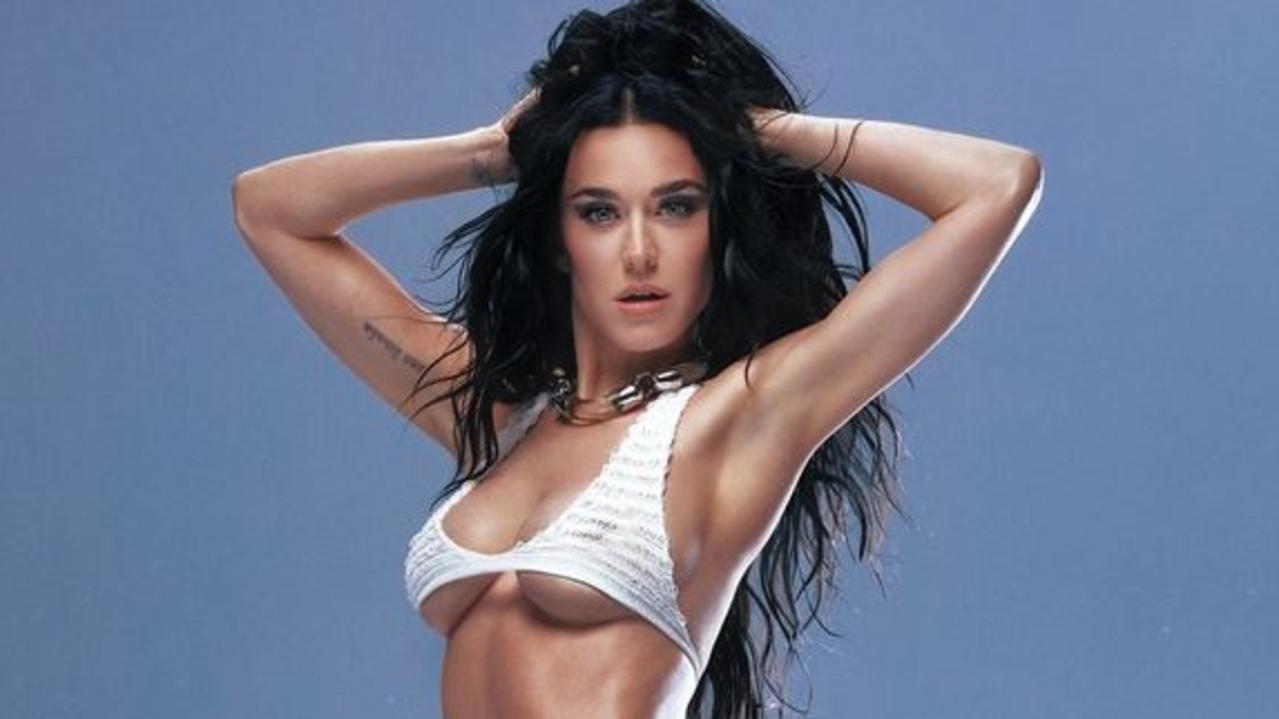

Rachelle Bland, a financial planner and investment adviser at Cliffe Consulting, said it was time for a review of how the foreign investment fund (FIF) regime worked, particularly with relation to portfolio investment entity (PIE) funds such as KiwiSaver.

The FIF regime offers a number of defined ways in which tax can be paid on investments in overseas equities.

But KiwiSaver schemes have to use the fair dividend regime (FDR) method.

That means, broadly, that each year an investor pays tax on 5% of the market value of their overseas shares. It does not matter if the shares have dropped in value, year-on-year.

If you have $100,000 of foreign shares, you pay tax on $5000, even if you have made no income from them.

Most listed Australian shares are not included.

Bland said KiwiSaver should be exempt from the regime.

Stuff

Many KiwiSaver members probably don’t understand how the tax works, Bland says.

“I’m all for paying my own way and paying tax where tax is due, but what is unfair is that all KiwiSaver members pay tax on FIF holdings – most people would be unaware of this, it is effectively a capital gains tax,” Bland said.

“Worse still, because it is charged through a PIE, providers can only use the FDR calculation method and members can’t use the optional method to claim FIF losses.”

She said her investment clients who were able to use other tax methods and declare losses in the most recent financial year paid much less tax, and in some cases had their investor tax rate reduced. Without this tax, KiwiSaver members would be much better off, she said.

She had one client who was invested in international assets via a unit trust. If they were being taxed via the FDR in the most recent tax year, they would have had a tax bill of $32,000 but using the comparative value method, which is not available to KiwiSaver investors, they had claimed a loss of $2200.

Making the other options available to KiwiSaver members would probably mean everyone filling out a tax return every year, she said. “Which they don’t want. So they’ve by stealth brought in a capital gains tax on foreign investments.

“I think it’s completely under the radar. People talk about how magnificent PIEs are because your tax is capped at 28% but there are major downsides in terms of offshore assets inside a PIE.”

The more growth assets an investor had, the more they were likely to be affected, she said,.

Rupert Carlyon, founder of KiwiSaver provider Kōura said he expected the FDR tax bill from KiwiSaver was significant. He said 70% or 80% of equities were invested offshore.

“It was a weird set of rules initially meant to compensate the fact that NZ companies were historically higher dividend-payers than their offshore counterparts so effectively this was meant to normalise out the tax. Today the NZX50 offers a dividend yield of about 3%, versus the S&P500 offering a dividend yield of 1.7% and a dividend yield on the MSCI AC World of about 2.5%. So if you are going to be consistent with the initial thinking and methodology then that 5% number is way too high.

“I would also suggest one of the reasons we have a shortage of R&D and growth in NZ companies is because they are too focused on maintaining their dividends rather than reinvesting in their businesses.”

James Arbuthnott, a partner at Deloitte, said he could understand the concern in an environment where markets were not strong, but in recent years when investors were making 15% or 20% gains on global equities, 5% had been appealing.

“There’s a simplicity tradeoff.

“We’ve had a period where returns were significantly suppressed since Covid versus what they were when we came out of the GFC until Covid. Returns were very rarely below 5% so no one was concerned about paying tax on 5%.”

Bland said it was an uneven playing field compared to investments in rental property.

“No one else gets capital gains tax-free from their investments like rental property owners do… What will the absence of a capital gains tax or interest deductibility on rental property really cost NZ over the coming decade? Probably billions. Meanwhile, first-home buyers can’t enter the market, and rental prices continue to escalate.”

Inland Revenue said it could not say how much tax was being paid under the FDR method by KiwiSaver schemes.