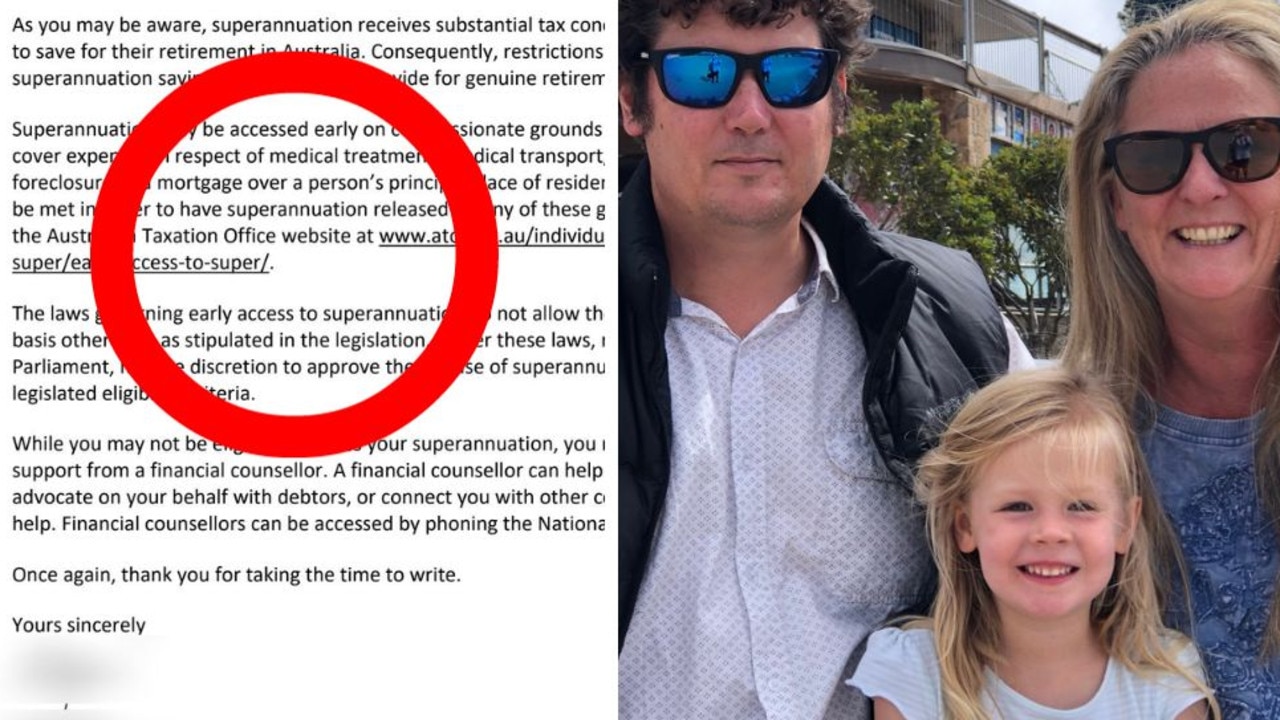

A homeowner left financially ruined from millions of dollars worth of building defects in her apartment block is disappointed that the government has rejected her plea for early access to her superannuation.

Tamara Railton-Stewart, 48, believes she has now exhausted most of her options to scrape her way out of a lifetime of debt.

The mum-of-one is among a number of victims involved in the collapse of Melbourne building company Shangri-La Construction, which went into liquidation in March this year.

There were 10 residential apartment blocks across Melbourne, including the one where Ms Railton-Stewart resides, that were in various stages of taking legal action over defective building work when the company went under.

One single claim for a block of units was for $10 million worth of damages, including cladding problems and water leaks, at a different location.

Although Ms Railton-Stewart and the nine other residents in her block received a $2 million insurance payout that covered some of the defect costs, she is still $39,000 behind in payments to strata, for money that had to be taken out to fix the apartment block’s problems over the past decade.

“I think people in my position should have access to their super,” she lamented to news.com.au. “I am not asking for a hand out, but simply access to my own money.”

But earlier this month, Ms Railton-Stewart received a hammer blow from the Australian Treasury, which denied her plea for early release superannuation on compassionate grounds.

It’s particularly a slap in the face for the Melbourne resident because earlier this year there were reports of Australians using a loophole in the early release superannuation scheme for cosmetic surgery procedures, and there’s also been a push as recently as this month trying to allow Aussies to use their super to buy their first home.

“The treasury department will release superannuation to people for a boob job (and) a liposuction” Ms Railton-Stewart said, referencing an incident from earlier this year where assistant treasurer Stephen Jones warned that people were gaming the early release super system to do just that.

“But we’re looking at a lifetime of financial f***ness because we can’t get access to it.”

She said she had been applying for her superannuation since February this year as she and her partner “were coming off a two-year hardship agreement” with the bank and “there was no (other) way I could find the money for that $40,000 and the mortgage”.

The government allows Australians to access their super early on “specific compassionate grounds” such as to cover expenses for medical treatment or preventing mortgage foreclosure.

Although the last point applies to Ms Railton-Stewart, she has now been rejected three times.

Her circumstances do not meet the strict criteria because her bank has not yet threatened to repossess her home.

She and the rest of her family also had to move out of their apartment for a period of time because of rampant mould, which means it did not count as her principal place of residence and therefore did not meet the criteria.

“I just want my life back, I want to be a mum to our daughter and a partner to her dad. My life has been consumed with this nightmare,” read part of Ms Railton-Stewart’s plea, to Stephen Jones, the assistant treasurer and Financial Services Minister.

“This financial nightmare that we are still living in, has been going on for (as at today’s date) 2909 days, or 415 weeks, or 95 months, or eight years. Please help us.”

Do you have a similar story? Get in touch | alex.turner-cohen@news.com.au

But her request was denied.

“I am sorry to hear about the difficult financial circumstances you have faced over many years due to the construction defects of your apartment building and the subsequent legal costs,” the rejection letter, sent from the Australian treasury department, responded earlier this month.

It later said ministers and members of parliament were not in a position to bend the rules.

“While you may not be eligible to access your superannuation, you may be interested instead in seeking support from a financial counsellor,” the letter added.

A spokesperson for the office of Stephen Jones said to news.com.au “No government minister has the ability to approve or deny claims for early release of super.

“We understand people are doing it tough, which is why we’re focused on providing targeted cost of living relief.

“We don’t want people to have to choose between their retirement savings for the future and making ends meet today.”

Ms Railton-Stewart has been forced to pick up the pieces of her life ever since buying a Shangri-La apartment in 2014, in a decision she now deeply regrets.

“It destroyed me,” she said.

Things were looking up for the then-39-year-old when she nabbed her $649,000 two bedroom, two-bathroom ground unit with a sprawling backyard nearly a decade ago.

She had just survived cancer near her heart in what was considered a medical miracle, had recently met a man who would go on to become her life partner and within a few years of moving into the flat, she had fallen pregnant, despite doctors thinking it impossible after her chemo treatment.

But then serious defects emerged in her home and the fairytale dream soon turned into a nightmare.

Just a month after moving in, in December 2015, Melbourne endured a massive downpour.

“We woke up Boxing Day morning, my partner got out of bed. There was water running from the back wall of the bedroom, through our wardrobe, into the hallway,” she recalled.

From there, more and more defects emerged.

Ms Railton-Stewart’s young daughter was diagnosed as asthmatic at just 16 months old and she believes the mould played a big part.

She also said the family had to stay in the mould-riddled apartment during Melbourne’s many lockdowns.

“I would go through cancer 10 times over to never relive the nightmare of this apartment ever again,” Ms Railton-Stewart said.

“Cancer was easier than this.”

News.com.au contacted the director of Shangri-La Construction for comment.

Previously, news.com.au reported on another group of residents also impacted by Shangri-La Construction’s collapse, which left them footing a $4.5 million bill from defects.

Unlike Ms Railton-Stewart, these residents were not covered by any insurance whatsoever.

Several independent building reports found their building, in West Footscray, had inadequate waterproofing, causing some residents to experience waterfalls in their lounge rooms, resulting in rampant black mould and rendering some properties too dangerous to live in.

News.com.au spoke to 11 apartment owners at this block facing financial ruin, some of whom had had to move back in with their parents and others more than $10,000 behind in payments as their strata fees skyrocketed to pay for the repairs.

In the wake of news.com.au’s coverage, last month the state government put forward recommendations to better protect apartment owners in this situation.

alex.turner-cohen@news.com.au