Australia’s private health insurers are the latest to be called out after raking in $1.3 billion more in profits compared to two years ago in the middle of a cost of living crisis.

On Friday, the Australian Medical Association (AMA) released its 2023 Private Health Insurance Report Card, which found that private health care patients are getting less value for their money while making their insurer richer in the process.

According to the report, total margins for hospital insurance has surged 18 per cent since the 2021 financial year, an increase of an eye-watering $1.36 billion.

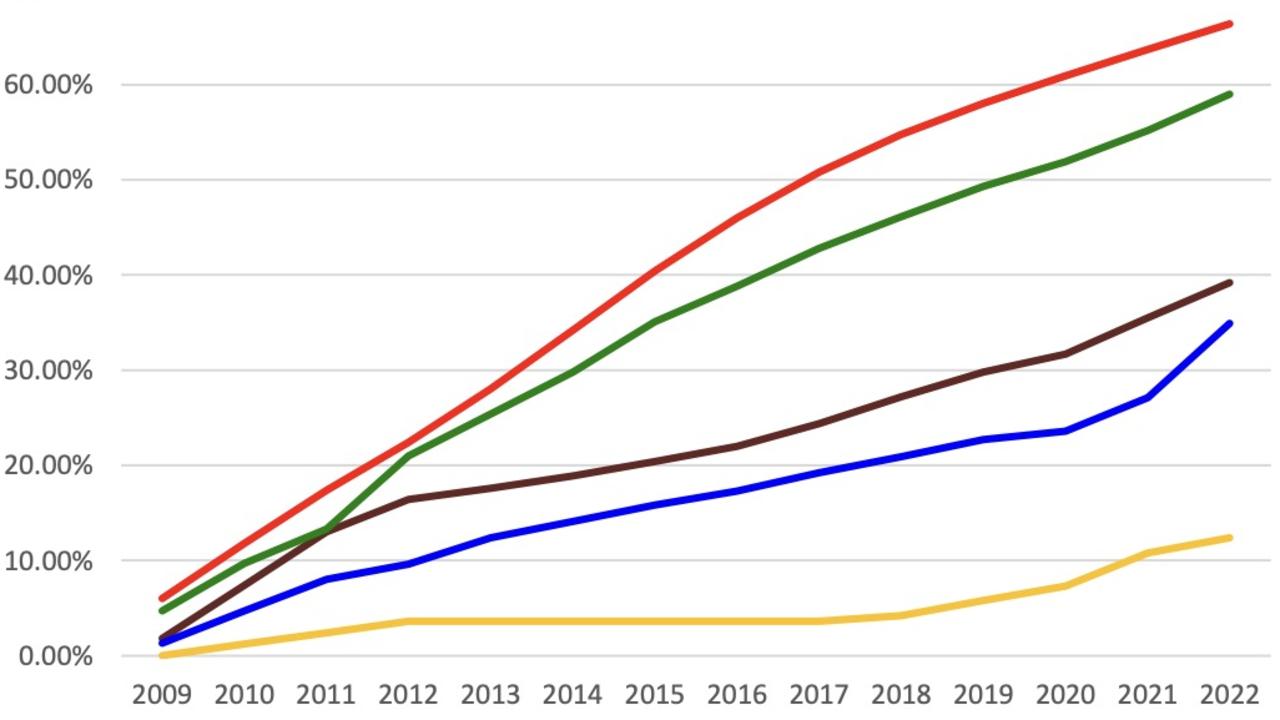

Medibank, Bupa, HCF, NIB and HBF have the biggest market share in Australia’s private health care sector, though the first two have a monopoly on just over half the entire market.

“The biggest for-profit private health insurers continued to grow over the past year,” the report noted.

AMA President Professor Steve Robson said the report highlighted the need for Aussies to shop around for private health cover.

“The reality is the value many consumers receive from their private health insurance is declining, relative to the big profits insurers are making,” Prof Robson said.

The AMA analysis found that the proportion of hospital insurance policy premiums returned to patients in the form of rebates and other benefits – or in other words the use of the services customers are paying for the privilege for – had declined in the past 24 months.

Hospital treatment fell to 81.6 per cent for the current period — down from 88.02 per cent in the 2018–19 financial year.

“As our private hospital system covers 40 per cent of Australia’s hospitalisations and performs two out of three elective surgeries, it is crucial the private health insurance sector thrives, especially as more and more pressure is heaped on our public hospitals,” Prof Robson said.

“However, there should be a mandated responsibility for all private health insurers to return a minimum amount of money that they receive back to their customers in the form of rebates and benefits.”

The massive range of pricing was also laid bare in the report, which exposed differences between insurers of more than $500 for the exact same medical procedures.

The example given was the uncomplicated delivery of a baby, where there was a 30 per cent rebate variation between the highest and lowest paying insurers. This equated to a staggering $520 difference.

Unfortunately, several insurers have merged into larger corporations.

“Amid the fallout from the pandemic, several smaller insurers were amalgamated into larger funds,” the report noted, making it harder for Aussie consumers to have their pick of the best option.

The uptick in the health insurers’ profits was attributed to the resumption of elective surgeries after the Covid-19 pandemic peak dropped.

The AMA also pointed out that health challenges were becoming more complex in the wake of the pandemic, including an ageing population and an increase in chronic health conditions.

The massive profit increase could also be part of the ‘greedflation’ phenomena.

Greedflation describes the situation when businesses use rising costs as an excuse to increase prices, rather than absorbing at least some of the additional costs themselves.

Corporate profits have been skyrocketing, raising questions over whether inflation is, in fact, being driven by greedy corporations.

Banks, insurers, airlines and telecoms are among those guilty of this type of price gouging.

The Australia Institute’s Centre for Future Work report: Profit-Price Spiral: The Truth Behind Australia’s Inflation found that “as of the September quarter of 2022, Australian businesses had increased prices by a total of $160 billion per year over and above their higher expenses for labour, taxes, and other inputs and over and above new profits generated by growth in real economic output”.